Identify the Compelling Evidence You Need to Start Winning Disputes

Fighting a chargeback that you believe was filed without proper justification? As a merchant, you’ll need to prove that the original transaction was valid. For that, you’ll need compelling evidence proving that you acted by-the-book and that the transaction should stand.

What is Compelling Evidence?

“Compelling evidence” refers to documentation that can helps prove your case in a transaction dispute. This can include:

- A receipt of delivery confirmation.

- Signed order showing that the customer received the item.

- Photos of the customer with the product.

- A signed contract validating the transaction.

These are just a few examples; the type of document used is less important than the function it plays. In the end, the goal is to build a convincing case that the customer made the transaction and received the product, and the sale should be upheld as a result. This process—called representment—demands a strategic approach, and the place to start is by examining the reason code attached to the dispute.

How Reason Codes Impact Compelling Evidence

Each card scheme has their own set of reason codes intended to signal why the chargeback was filed. The evidence you’ll need to fight the chargeback will vary depending on this code.

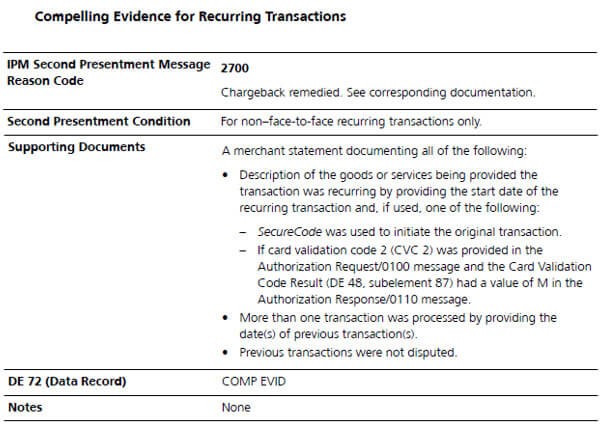

Acceptable evidence for each case is explained in the card scheme’s chargeback guidelines. For example, look at the example below for one Mastercard chargeback reason code:

Of course, this is just one of many possible reason codes for one brand of payment card. Looking at the industry overall, there are hundreds of possible reason codes you can encounter. Each one calls for a different response.

Obstacles to Your Compelling Evidence

Although there is a process in place you can use to identify the evidence you need, the odds are still against you:

Reason Codes are Not Reliable

The system was originally created in the 1970s, and while there have been plenty of policy adjustments over the years, the framework has remained fundamentally the same. The chargeback process was not created with eCommerce in mind, and does not account for the complexities of that environment. We’ve found that there are only three true sources of chargebacks:

- Merchant Error

- Criminal Fraud

- Friendly Fraud

Reason codes can’t identify friendly fraud, as the tactic relies on customers flying under the radar and disguising the true nature of their dispute to get something for free.

Representment Success is Unlikely

Representment is complicated and requires more energy than most merchants can afford. There are several reasons why the process is so difficult, including:

- Frequent updates to card scheme regulations: Regulation changes can occur multiple times a year. The average merchant won’t have the resources to stay on-top of these updates.

- The process is time-intensive: Collecting compelling evidence, reviewing policy, and communicating with banks and card schemes requires time that merchants can’t afford.

- No guarantee of success: Issuers can dispute representment cases—a process referred to as “arbitration”—to attempt a second chargeback in response to your evidence.

Our Recommendation: Don’t Go It Alone.

We offer a wealth of information to both merchants and cardholders regarding chargebacks. Even with all this data and insight at your disposal, though, you’re likely to find that disputing a chargeback is still more difficult than you can comfortably handle.

While fighting chargebacks may be more than you can handle, the process is not hopeless. What you need is the support of professionals who understand this subject and are prepared to do what’s necessary to protect your business.

Whether your chargebacks are the result of friendly fraud or genuine criminal fraud, we’re happy to help you identify the right business for your needs. Click here for more information.